Tennessee Commercial Auto Insurance

Stay on the road to success with commercial auto insurance

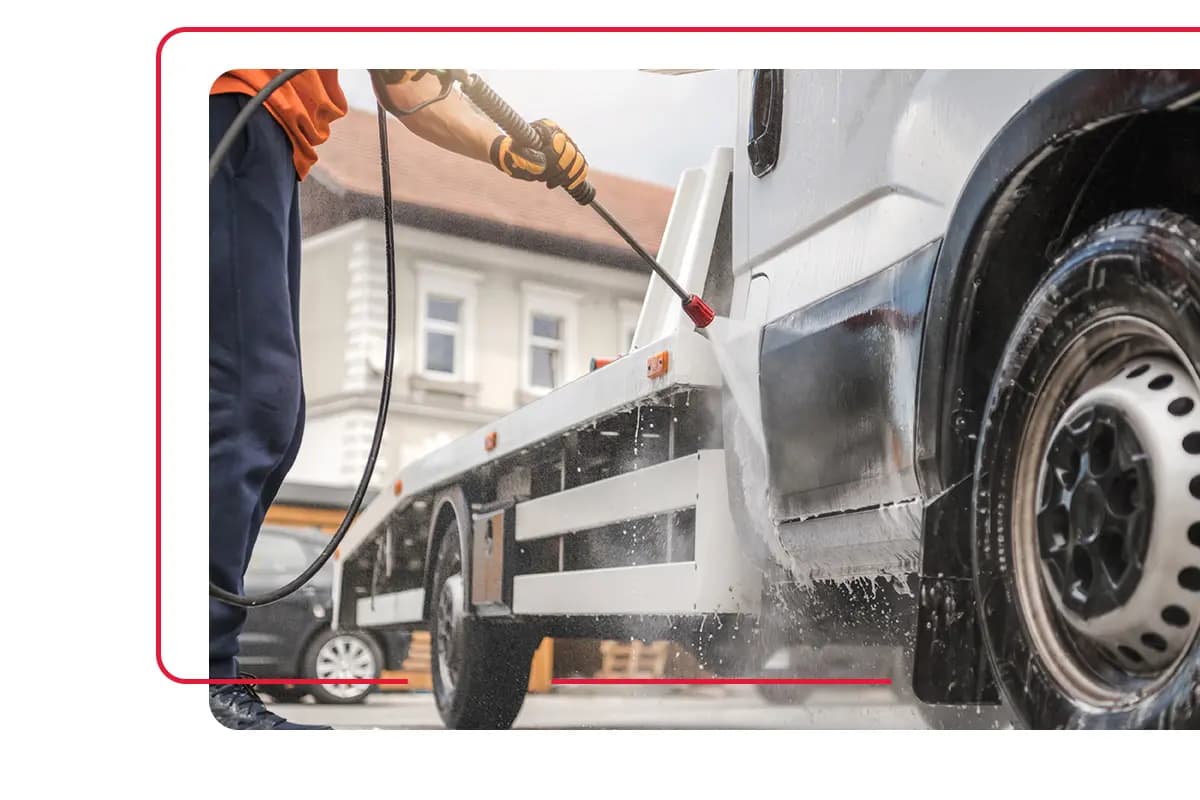

For Tennessee businesses relying on vehicles, our Commercial Auto Insurance is an essential safeguard. Whether you’re operating delivery vans, company cars, or specialized vehicles, Farm Bureau Insurance of Tennessee provides robust specialized coverage to protect your business against the unique risks associated with commercial vehicle use. Our policies are tailored for various business types, ensuring your business stays moving safely and legally.

Tennessee Commercial Auto Insurance

Stay on the road to success with commercial auto insurance

For Tennessee businesses relying on vehicles, our Commercial Auto Insurance is an essential safeguard. Whether you’re operating delivery vans, company cars, or specialized vehicles, Farm Bureau Insurance of Tennessee provides robust specialized coverage to protect your business against the unique risks associated with commercial vehicle use. Our policies are tailored for various business types, ensuring your business stays moving safely and legally.

Commercial Auto Coverages

Liability Coverage

What’s covered?

Covers legal and medical costs if your business vehicle is involved in an accident resulting in injury or property damage to others.

Why do I need this?

It's a legal requirement in Tennessee and crucial for protecting your business against costly lawsuits and settlements.

Non-Owned Vehicle Coverage

What’s covered?

Provides liability coverage for employees using their personal vehicles for business purposes.

Why do I need this?

Essential for safeguarding your business against risks when employees use personal vehicles for work, which aren't covered by personal auto policies.

Physical Damage Coverage

What’s covered?

Protects your business vehicles against damage from accidents, theft, or natural disasters.

Why do I need this?

To ensure quick recovery and repair of your business vehicles, keeping your operations uninterrupted.

Hired Auto Coverage

What’s covered?

Offers liability protection for rented or leased vehicles used for your business.

Why do I need this?

To protect your business when using hired or leased vehicles for various operations, ensuring all your vehicular assets are covered.

Providing Comprehensive Coverage For:

Delivery and Service Vans

Ensure your delivery and service vans are fully protected with specialized insurance coverages. This includes liability, collision, and comprehensive coverage—all essential for vehicles that handle frequent stops and carry valuable goods or equipment.

Company Cars

Company cars used for business activities need tailored insurance coverage. This encompasses liability, collision, and comprehensive insurance—protecting against accidents and damages while ensuring business continuity.

Construction and Landscaping Vehicles

Construction and landscaping vehicles require robust insurance protection against job-site risks. Coverage typically includes liability, equipment damage, and often additional protection for tools and machinery transported on these vehicles.

Food Trucks

Food truck insurance combines vehicle protection with business-specific coverages. This includes liability, property damage for the vehicle and attached equipment, and often additional coverage for food spoilage and employee-related risks.

Commercial Vans & Utility Vehicles

Commercial vans used for business purposes, such as transporting goods or equipment, need insurance that covers liability, damage to the vehicle, and often additional coverage for the contents and equipment carried within.

Our insurance for utility vehicles includes liability protection, coverage for damage resulting from accidents or unforeseen events, and often additional protection for specialized equipment carried on these vehicles.

Here for you whenever, wherever you go

Download your proof of insurance, pay bills, file a claim, and manage your policies in one place with My Account.

Common questions about commercial auto insurance

What types of vehicles are covered under commercial auto insurance?

Commercial auto insurance covers a wide range of vehicles used for business purposes. This includes delivery and service vans, construction and landscaping vehicles, company cars, livery services, food trucks, and heavy trucks like dump trucks and tractor-trailers. The coverage is designed for vehicles that face higher risks and often require specialized coverages compared to personal autos.

What are the minimum insurance requirements for commercial auto insurance in Tennessee?

In Tennessee, the minimum insurance requirements for commercial auto insurance are often referred to as 25/50/15. This means the policy will pay up to $25,000 for each person injured in an accident, $50,000 for all people injured in an accident, and $15,000 for all property damaged in an accident. These requirements provide basic liability coverage and may vary based on the vehicle type and use.

How are premiums for commercial auto insurance calculated?

Premiums for commercial auto insurance are based on several factors, including the number of vehicles, type and value of the vehicles, the level of risk involved, claims history, employee driving records, and the policy deductible and limits. Additional considerations include the profession and industry risks, vehicle usage, driving history, business location, travel radius, and specific coverage needs. Premiums can vary widely based on these factors.

Can I add additional coverages to my commercial auto insurance policy?

Yes, you can add additional coverages to your commercial auto insurance policy to suit your specific business needs. Common additions include comprehensive coverage, collision coverage, and coverage for leased or hired vehicles. Your insurance provider agent can help you tailor your policy to address the unique risks associated with your business.

What should I do if I need to file a claim under my commercial auto insurance policy?

Filing a claim under your commercial auto insurance is a straightforward process. Begin by contacting your local Farm Bureau Insurance agent promptly and providing details of the incident. This typically includes information about the date, time, and location of the accident, involved parties, and a description of damages. Your agent will guide you through the necessary steps and documentation required for a smooth claims process.